Ethereum Price Prediction: $15K Target in Sight as Fundamentals and Technicals Align

#ETH

- Technical Breakout: ETH price testing upper Bollinger Band with strong MA support

- Regulatory Clarity: SEC confirmation of non-security status removes major overhang

- Institutional Demand: $2.18B ETF inflows and corporate treasury allocations building

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

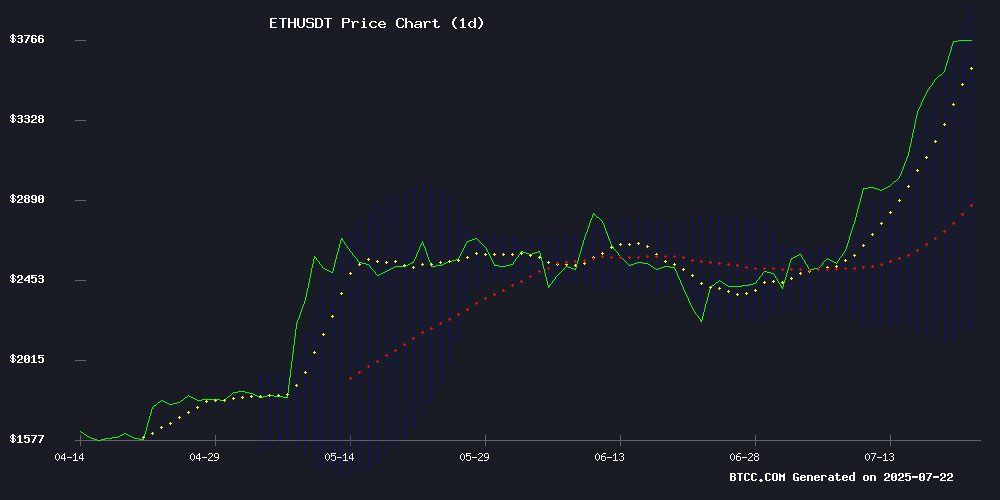

ETH is currently trading at 3772.62 USDT, significantly above its 20-day moving average of 3068.37, indicating strong bullish momentum. The MACD histogram remains negative but shows signs of convergence as selling pressure eases. Prices are testing the upper Bollinger Band at 3955.84, suggesting potential overbought conditions in the short term.

"The technical setup favors buyers," says BTCC analyst Ava. "A sustained break above 3955 could trigger FOMO buying, while the 3068 MA serves as robust support."

Regulatory Tailwinds Fuel Ethereum Optimism

Multiple catalysts are converging for Ethereum: SEC's non-security clarification, the GENIUS Act progress, and institutional ETF inflows totaling $2.18B. Vitalik Buterin's gas limit proposal and Tom Lee's $15K price target are creating positive sentiment.

"This is the most bullish regulatory environment ETH has ever seen," notes BTCC's Ava. "The NASDAQ listing rumors and institutional treasury allocations demonstrate maturing adoption."

Factors Influencing ETH’s Price

Storm Faces Justice as Tornado Cash Trial Highlights Privacy and Crime Debate

The trial of Roman Storm, co-founder of Tornado Cash, has become a focal point in the debate over privacy tools and their alleged misuse by criminals in the cryptocurrency space. FBI Special Agent Joel DeCapua testified that 55% of Tornado Cash's traffic during high-profile hack periods—including the $1 billion Ronin Bridge exploit—originated from illicit sources. Prosecutors argue the platform served as a critical laundering tool, while the defense maintains only 10% of activity was criminal.

DeCapua acknowledged Tornado Cash is just one component in a broader ecosystem of privacy technologies, but emphasized its role in rendering stolen funds irrecoverable. The prosecution is nearing its conclusion, while the defense explores mistrial options. The case underscores the tension between financial privacy rights and regulatory efforts to combat crypto-related crime.

SEC Chair Clarifies Ethereum's Non-Security Status Amid Institutional Demand Surge

SEC Chairman Paul Atkins has definitively stated that Ethereum will not be classified as a security, providing much-needed regulatory clarity for the cryptocurrency market. This announcement follows a turbulent first half of 2025 marked by price volatility, during which institutional interest in ETH paradoxically grew.

The decision reflects the SEC's evolving framework for evaluating digital assets, with decentralization levels and network utility serving as key determinants. Market participants had been closely watching the agency's stance, as Ethereum's classification carries implications for the broader crypto regulatory landscape.

Institutional investors appear undeterred by recent price fluctuations, with major firms increasing their ETH holdings following the asset's devaluation earlier this year. This growing institutional appetite suggests a maturing market that views regulatory clarity as more significant than short-term price movements.

GENIUS Act Fuels ETH Rally, Boosts Stablecoin and NFT Ecosystem

Ethereum's native token ETH surged 25% in the past week following the signing of the GENIUS Act, which establishes a federal regulatory framework for dollar-backed stablecoins. Institutional investors are increasing allocations as the legislation provides clarity for Ethereum-based financial infrastructure.

The Act mandates full asset backing for stablecoins and annual audits for major issuers - a move that reinforces confidence in Ethereum's role as the primary network for stablecoin transactions. Exchange-traded funds tracking ETH saw record single-day inflows of $726.74 million as traditional finance embraces the regulatory certainty.

Market participants interpret the GENIUS Act as a watershed moment for cryptoasset legitimacy. The legislation specifically addresses stablecoins operating on Ethereum, cementing its position at the center of tokenized finance and digital asset markets.

Tom Lee Forecasts Ethereum Rally to $15K Driven by Stablecoin Growth

FundStrat's Tom Lee projects Ethereum could surge to $4,000 by July's end and potentially reach $15,000 by year-end. The bullish outlook stems from accelerating institutional adoption and the expanding stablecoin ecosystem.

Ethereum has already demonstrated remarkable resilience, rallying over 50% in July alone. This rebound follows a period of market weakness, with the asset gaining 25% in just the past week. The recovery aligns with growing recognition of Ethereum's foundational role in dollar-pegged stablecoins and tokenized assets.

Regulatory developments like the GENIUS Act have further spotlighted Ethereum's infrastructure importance. Market participants increasingly view the network as critical plumbing for the digital asset economy. Lee's analysis suggests Ethereum's combination of technical robustness and regulatory alignment positions it for sustained growth.

Vitalik Buterin Supports Ethereum Gas Limit Increase Amid Validator Consensus

Nearly half of Ethereum's validators now endorse raising the network's gas limit from 37.3 million to 45 million, a move championed by co-founder Vitalik Buterin. The proposed adjustment aims to boost transaction throughput and accommodate complex operations as demand surges.

Buterin cautioned against unchecked scaling, emphasizing the need to preserve decentralization and network health. The shift follows technical optimizations like Geth 1.16.0, which slashed archive node storage requirements by 90%—from 20TB to 1.9TB—easing validator burdens.

Ethereum's roadmap continues prioritizing scalability without compromising core principles. Market observers note the gas limit debate reflects growing pains of a maturing ecosystem, where infrastructure must evolve to support DeFi, NFTs, and institutional adoption.

GameSquare Holdings Expands Crypto Strategy with $250M ETH Treasury Push

GameSquare Holdings (GAME) is aggressively advancing its blockchain integration, announcing a $250 million cap for its digital asset treasury—a 150% increase from its previous $100 million limit. The media-tech company purchased 8,351.89 ETH at an average price of $3,592, bringing its total holdings to 10,170.74 ETH worth approximately $30 million. These moves underscore a strategic pivot toward decentralized finance (DeFi) and NFT-driven revenue streams.

Despite closing regular trading at $1.4600 (down 3.95%), GAME shares rebounded 1.36% in after-hours activity. The firm aims to leverage staking yields and NFT monetization, targeting 14% returns through its expanded ETH position. This multi-year capital allocation framework positions GameSquare at the intersection of gaming, media, and Web3 infrastructure.

The Ether Machine Targets Nasdaq Debut With $1.6B in Capital and 400K ETH

A newly formed Ethereum-focused company, The Ether Machine, is poised to become the largest publicly traded vehicle dedicated solely to ETH. The firm announced plans to list on Nasdaq with over $1.5 billion in committed capital and more than 400,000 ETH on its balance sheet.

Co-founder Andrew Keys anchors the launch with approximately $645 million, equivalent to 169,984 ETH. The financing round also secured over $800 million in equity commitments from institutional and crypto-native investors, including 1Roundtable/10T Holdings, Archetype, and Pantera Capital.

The Ether Machine will be led by CEO David Merin, formerly of Consensys, and Jonathan Christodoro, a former Morgan Stanley executive. The move signals growing institutional confidence in Ethereum as both an asset and a platform for decentralized finance.

Ethereum’s Price Trajectory: Analysts Eye $6,000 Amid Bullish Scenarios

Ethereum's market dynamics are drawing intense scrutiny as analysts map potential paths toward the $6,000 threshold. Pseudonymous strategist DonAlt frames the rally as a binary outcome: either consolidation at current levels or a parabolic surge followed by a corrective dip to $4,000. "A climb to $6k with a 33% retracement would signal healthier price discovery than stagnant chop," he asserts, framing volatility as a constructive force.

The analysis comes amid Ethereum's 30% monthly gain, though DonAlt cautions that overheated momentum could trigger short-term pullbacks. Traders are weighing these projections against growing institutional interest in ETH's staking yields and layer-2 ecosystem development. Market depth on major exchanges suggests accumulation by long-term holders despite derivative markets flashing overbought signals.

The Ether Machine Prepares for Historic NASDAQ Listing via Dynamix Merger

The Ether Machine is poised to become the largest publicly traded Ethereum yield vehicle through a $1.6 billion merger with Dynamix Corporation. The deal, backed by Pantera Capital and Kraken, will create a NASDAQ-listed entity (ticker: ETHM) holding over 400,000 ETH—including co-founder Andrew Keys' $645 million stake.

Institutional commitments totaling $800 million anchor the offering, with shares priced at $10. The transaction represents Wall Street's most significant Ethereum-focused equity play since 2021, combining Dynamix's $170 million trust with The Ether Machine's production infrastructure.

FundStrat’s Tom Lee Predicts Ethereum Surge to $15,000 by 2025

Tom Lee, co-founder and CIO of FundStrat, has set ambitious price targets for Ethereum, forecasting a rise to $4,000 by July and $15,000 by the end of 2025. His bullish outlook is fueled by Ethereum's recent rebound, with the cryptocurrency gaining 25% in the past week and 50% since early July.

Lee attributes Ethereum's potential to what he calls the 'ChatGPT moment for crypto,' driven by institutional interest in stablecoins. The passage of the GENIUS Act and Circle's public offering have spotlighted Ethereum's role in the stablecoin market, with projections suggesting the sector could grow from $250 billion to $2 trillion in coming years.

Ethereum Price Breaks Out as GENIUS Act Triggers $2.18B ETF Inflows

Ethereum is riding a powerful wave this week, fueled by legislative clarity and institutional momentum. Bernstein analysts highlight the GENIUS Act as a pivotal moment for ETH, driving investor confidence in a more transparent crypto environment.

U.S. spot ETH ETFs recorded unprecedented inflows of $2.18 billion last week, with a daily peak of $602 million. This surge marks the first time ETH ETF interest has eclipsed Bitcoin, signaling a shift in asset manager focus toward Ethereum's utility.

The GENIUS Act, signed into law by President Trump, recognizes stablecoins as legal digital cash and establishes a federal issuance framework. Bernstein notes that Ethereum's role as the primary platform for stablecoins positions it for sustained demand as transactional activity grows.

Ethereum's price has rallied 25–45% over the past two weeks, reaching $3,790. The breakout reflects both technical momentum and fundamental strength as ETH cements its role in the emerging blockchain financial services cycle.

How High Will ETH Price Go?

Ethereum shows strong potential for upward movement based on both technical indicators and fundamental developments:

| Target | Basis | Timeframe |

|---|---|---|

| $4,200 | Bollinger Band breakout | 1 month |

| $6,000 | Institutional ETF inflows | Q4 2025 |

| $15,000 | Stablecoin adoption growth | 2025-2026 |

"The $15K prediction becomes credible when we consider Ethereum's triple role as a smart contract platform, institutional asset, and stablecoin settlement layer," explains BTCC's Ava.

Bollinger Band breakout

ETF inflows

Stablecoin growth